Your financial situation…

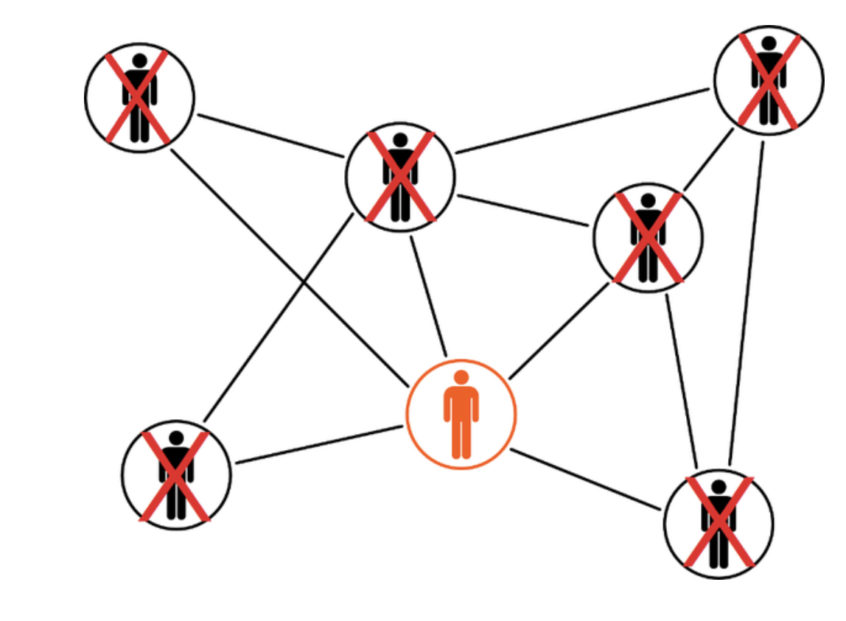

Is largely dictated by the money mindset you borrowed from your family system…

Unfortunately, for most of us, that tends to be a scarcity mindset—full of stress, worry, negative attitudes, and limiting beliefs.

Whereas very few of us had role models with an abundant mindset…

Full of confidence, creativity, positivity, resourcefulness, and optimism.

An abundant mindset sees money as an exciting, readily-available tool to exchange value, express yourself, create freedom, and allows you to pursue financial opportunities that you’d otherwise be blind to.

Let’s say you were single and dating, and believed there were no good partners out there for you…

Would you be likely to find one? Probably not. And you wouldn’t have much fun in the process. Because your scarcity mindset shuts down those possibilities, and causes you to operate in ways that repel a relationship, rather than inviting one in.

The limiting effect happens with both dates and dollars, plus opportunities for jobs, businesses, or investments.

And if you think you might be operating from scarcity, I have good news…

Just as it’s possible to reparent yourself…

It’s also possible to replace a scarcity mindset with an abundant mindset.

In the next email, I’ll run you through an exercise to begin doing exactly that, which is very similar to one I’ve facilitated in exclusive weekend workshops with the world’s greatest financial minds…

Until then, to get your gears turning, I’ll invite you to ponder a question once shared with me by a brilliant and wealthy friend:

“What did you hear at the top of the stairs about money?”

Meaning: When you were growing up, how did your parents talk about money around the house? What was their financial attitude? What silent beliefs did they demonstrate through their actions?

Maybe they were comfortable and carefree. Or maybe they openly fought about it in the kitchen, and repeated phrases like:

“We can’t afford that…” “Money doesn’t grow on trees…” or “Money is the root of all evil…”

Of course, budgeting intelligently is a vital skill (and money can’t actually be evil, though people with wounded psyches can).

But beneath most of these adages, you’ll find a negatively charged psychology of scarcity and fear…

And that mentality can stick with you for the rest of your life, restricting your ability to earn, invest, and thrive. And you will remain unhappy, even if success does arrive.

Next time, we begin reprogramming.

Best,

Neil